For over 30 years, FOCA has provided risk management and insurance programming support to member associations.

FOCA is not an insurance agent, and membership in FOCA does not afford any automatic insurance coverage. However, volunteers, employees and directors of organizations should always be mindful of risks. This means examining situations cautiously, and thinking ahead to the potential consequences of decisions and actions. It is a good idea for associations, regardless of their size, to review their exposures and consider risk management options on a regular basis.

Learn about risk management below, and share the information with your association and waterfront neighbours.

June 21, 2023 – Municipalities may now require cottagers to have liability insurance for uses off their property (Cottage Life) – quoting Terry Rees of FOCA, and Ross Fraser or Cade Associates Insurance Brokers (administrators of FOCA’s Association Liability Insurance Program)

FOCA's Insurance Programs:

These insurance programs are an important part of the value FOCA delivers to Ontario’s waterfront community. We invite members to investigate these insurance coverages, which are administered by Cade Associates Insurance Brokers.

- Call Cade Associates for a quote today: 1-844-223-3178 or visit them online: https://cadeinsurance.com/foca/

Hundreds of our member Associations participate in FOCA’s Association Insurance Program (download PDF, 2 pages), which provides coverage options applicable to Lake Associations, Road Associations, Land Ownership Associations or Trusts, as well as coverage options for Directors and Officers.

This insurance coverage includes valuable access to a Legal Helpline for the Association, provided by DAS Legal Protection Inc. Contact the FOCA office for details on how to access the Legal Helpline.

The FOCA Liability Insurance Program offers improved coverage and enhanced limits at premium levels at very competitive rates, and is underwritten by Aviva Canada. Through this long-standing program, FOCA Member waterfront and road Associations can access significant coverage, enhanced limits at premium levels, and competitive rates on insurance. FOCA encourages our member associations to take steps to protect their volunteers. Understanding your risks and using the appropriate tools to reduce them are important steps in defining your insurance coverage requirements.

For more about understanding risk, members are encouraged to read more below.

For more about rock and shoal marking in particular, visit FOCA’s boating webpage.

Many FOCA member associations are involved with the use and/or maintenance of rural roads. Learn more about Road Association Insurance (download PDF, 2 pages) and also consult FOCA’s Road Issues webpage for additional important information. There are special risk management considerations for road associations, and FOCA encourages you to review your risks!

CottageFirst is the complete solution for your insurance needs, bundling together your cottage, boat, home, car, and other personal insurance products. It was designed by cottagers, for cottagers, in consultation with FOCA, and underwritten by Travelers Canada. Bundle your insurance to save, and receive the peace of mind that comes from working with an independent insurance broker who is well-versed in cottage living. Since 2014, FOCA and Cade Associates Insurance Brokers have proudly offered a group insurance program exclusively available to FOCA member families and Friends of FOCA (our annual supporters).

FOCA Associations: make sure your member families know they are part of FOCA, and eligible to apply for this exclusive insurance offering! Get a quote from Cade Associates Insurance Brokers: 1-844-223-3178 clientservices@cadeinsurance.com

FOCA encourages all waterfront property owners to review your insurance, and know what you are actually covered for!

June 14, 2022 – Is your cottage covered against fires? (Cottage Life) – Cade Associates Insurance Brokers, who administer the CottageFirst insurance program exclusively available to FOCA members, are quoted in this article.

MEMBERS: Login below for a 5-minute video about liability considerations for associations hosting boat parades and other on-water events:

You're missing members-only content!

The following video about liability considerations for associations hosting boat parades or other on-water events is only available to members of current FOCA Member Associations.

If you are already registered on the new FOCA website, please login below with your Username and Password.

Need help with your login? Contact us for assistance during business hours. Not yet a Member Association? Find out why you should be!

Fact Sheets & Resources for Members:

You're missing members-only content!

The following resources are only available to members of our current Member Associations.

Tips For Associations:

- FOCA Association Insurance Program Overview

- Road Association Insurance Issues Overview

- Volunteer Accident Compensation Coverage

- Alcohol at Association Events

- Waivers

- Water Hazard Markers

Articles & Presentation Slides for Associations:

- Associations in Action: Do Good Things & Stay out of Trouble! (Cade Associates Insurance Brokers presentation @ FOCA AGM & Spring Seminar 2020)

- Insurance Q&A for Associations (Cade Associates article in the 2018 FOCA Lake Stewards Newsletter)

- Risk Management & Insurance for Road Groups (Cade Associates article in the 2014 FOCA Lake Stewards Newsletter)

If you are already registered on the new FOCA website, please login below with your Username and Password.

Need help with your login? Contact us for assistance during business hours. Not yet a Member Association? Find out why you should be!

You're missing members-only content!

The following fact sheets and resources are only available to members of our Member Associations & current Friends of FOCA (our annual supporters).

Tips For Individuals:

- Cottage Insurance Tips

- Understanding Your Insurance

- Bubblers

- Building or Renovating a Cottage

- Emergency Preparation: Snow & Ice

- Emergency Preparation: Wind & Rain

- Generator Safety

- Water Sensors

- Winter Maintenance Tips

- Woodstove Safety Tips

If you are already registered on the new FOCA website, please login below with your Username and Password.

Need help with your login? Contact us for assistance during business hours. Not yet a Member Association? Find out why you should be!

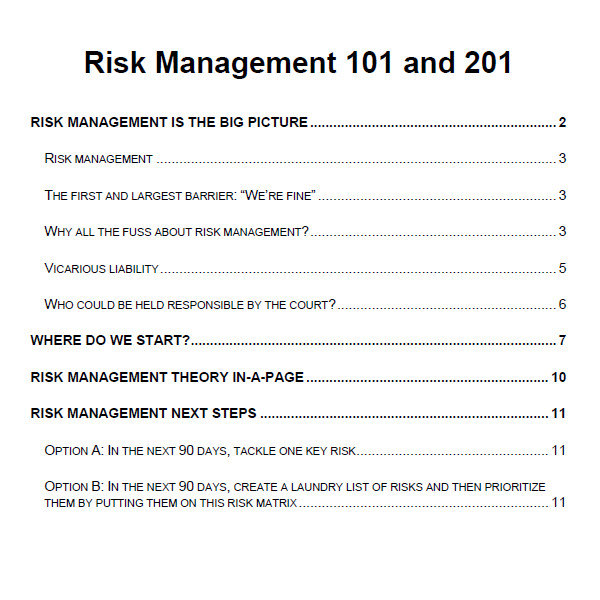

Risk is around us in everything we do; however, there are ways to manage risk. Read more, below…

The process of risk management can be simplified to these steps:

- looking at a situation and asking what can go wrong and what harm could result

- prioritizing your risks and determining the key risks

- identifying practical measures that can be taken to keep key risks in check (and to minimize harm or damage if the risk does occur)

- communicating these measures to your people (important risk management steps need to be communicated several times in several ways, including in writing)

- starting and then monitoring these actions over time to make improvements

Practical measures that can be taken to manage risks fall into these categories:

- assume the risk (decide that the risk is minor and do nothing)

- reduce the risk (find ways to change people’s behaviour or the environment in which people work so that the degree of risk is reduced)

- eliminate the risk (choose not to do something) and

- transfer the risk (accept the risk but transfer the liability associated with it to someone else through a written contract).

Every organization will face different risks and will plan and implement different measures to deal with these risks.

The measures that are taken to manage risks are usually those that would be taken by any other prudent and reasonable person having the same skills, knowledge and experience as ourselves. This is why the practice of risk management is based in large part on common sense and is linked to the concept of “standard of care.”These measures will tend to revolve around:

- training and educating staff and volunteers

- enforcing reasonable rules

- inspecting and maintaining facilities and equipment

- screening and supervising staff and volunteers

- properly documenting meetings and decisions

- meeting all statutory reporting requirements.

FOCA's Risk Management Manual for Associations

For more detailed information, or to get started on your association’s own risk management process, download a free copy of the FOCA Risk Management Manual (available only to current FOCA Member Association members). This 244-page publication was developed for FOCA by Imagine Canada’s Insurance & Liability Resource Centre for Non-Profits in 2005, and was updated in 2008.

You're missing members-only content!

The following resources are only available to members of our Member Associations & current Friends of FOCA (our annual supporters).

If you are already registered on the FOCA website, please login below with your Username and Password.

Need help with your login? Contact us for assistance during business hours. Not yet a Member Association? Find out why you should be!

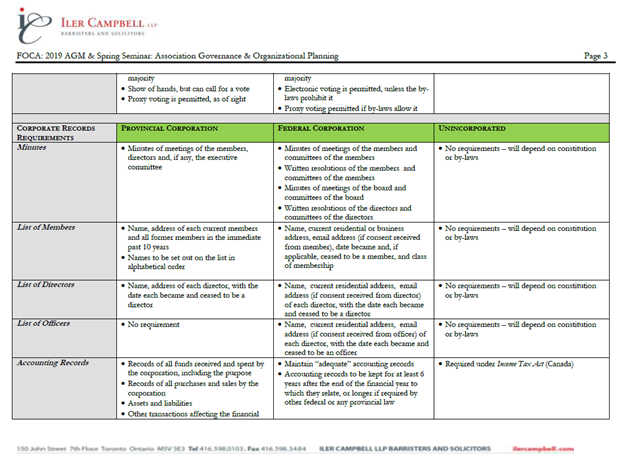

ALSO: download a governance tips sheet

This members-only resource was created by governance lawyer Ted Hyland, who gave a talk to our members in 2019 (before ONCA came into effect). If features different considerations if you are incorporated (provincially or federally) versus an unincorporated association. Find out about keeping Minutes, government filings, tax requirements, audits and more!

NOTE: This should not replace professional advice about your particular situation.

Download a digital copy (PDF, 7 pages)