FOCA advocates for fair property taxation on behalf of waterfront residential property taxpayers in Ontario.

Read onward, or jump immediately to the following sub-topics on this page:

Capital Gains Tax (CGT)

Municipal Property Assessment Corporation (MPAC) and understanding or challenging your property assessment

Underused Housing Tax (UHT)

Foreign Homebuyer Ban (federal) & Foreign Homebuyer Tax (provincial)

BREAKING NEWS – March 21, 2025 – Prime Minister Carney announced the Government of Canada will cancel the proposed hike in the capital gains inclusion rate. Read the news release.

Capital Gains Tax - Earlier News & Background on the Issue:

On behalf of our members, FOCA has fought against this increased tax through phone calls to elected officials, letters to government, and supporting our members to take action using our customizable template to write hundreds of letters to MPs, each sharing personal stories about how this tax left their families negatively affected.

January 31, 2025 – the Government of Canada has just announced a deferral (until January 1, 2026) in implementation of their proposed change to the capital gains inclusion rate. Read the Government news release here. This is welcome news for seasonal waterfront property owners! With a federal election looming, FOCA expects to get the result we lobbied for: to ditch this change which would negatively impact tens of thousands of middle-class families across Ontario alone. Read more, below.

Related Capital Gains Tax News:

Jan. 27, 2025 – B.C. firm seeks injunction stopping capital gains hike proposed by federal Liberals (Canadian Press)

Jan.23, 2025 – Opinion: The CRA’s unconstitutional money grab (National Post)

Jan.7, 2025 – Here’s how capital gains tax changes will work after Parliament prorogued (Global News)

Jan. 6, 2025 – Justin Trudeau announced he will resign his post as Prime Minister once a new leader of the federal Liberal party is chosen. He then prorogued Parliament which will not sit again until March 24. This brings to an end all Government bills that were in progress, making it unlikely that the capital gains tax inclusion rate change announced by the Federal Government last summer will ever become law. However, the Canada Revenue Agency announced the 2024 tax forms will reflect the higher inclusion rate. Read about the complexity from the legal minds at Fasken, and be certain to get professional advice about your own tax situation.

Earlier News:

On June 11, 2024 a “Ways and Means” motion for the implementation of the capital gains tax change passed in the House of Commons, by a vote of 208 to 118.

Read FOCA’s June Media Release on the subject; related media coverage can be found below.

On behalf of our members, FOCA has fought against this increased tax through phone calls to elected officials, letters to government, and supporting our members to take action using our customizable template to write hundreds of letters to MPs, each sharing personal stories about how this tax left their families negatively affected.

FOCA remains dedicated to the momentum of advocacy for cottage country, and to keeping our members and our supporters active and actioned.

Earlier related news: On April 16, 2024, Finance Minister Chrystia Freeland tabled a 2024 federal budget including an announcement that the capital gains tax on amounts over $250,000 will rise on or after June 25, 2024. This will negatively impact many FOCA members who sell or transfer ownership of their cottages to the next generation. FOCA wrote the government in opposition to this development. Download FOCA’s April letter (PDF, 1 page) and encouraged members to write their own MPs (see more below).

WRITE YOUR M.P. – FOCA encouraged everyone to download a template letter (Word document) that you can customize to write to your own MP, explaining the negative impact of this development on your family. PLEASE copy FOCA on your letter (cc. communications@foca.on.ca), and consider a donation (above) to support our ongoing work.

Learn more about capital gains tax on our Cottage Succession Planning webpage, and read related media coverage on the capital gains tax issue in the links below:

June 25, 2024 – How changes to capital gains taxation are affecting cottage properties in the Ottawa Valley (CTV News Ottawa)

June 25, 2024 – No spike in cottage, investment property sales as new capital gains rules take effect: “Realtors say most of those making deals before the deadline were families passing down cottages” (CBC News) – FOCA notes: this article includes an embedded video by CBC’s Andrew Chang that provides a very clear overview of how the capital gains tax change applies in various situations; click to watch the video directly: https://www.cbc.ca/player/play/video/9.6423015

June 22, 2024 – ‘It’s not fair’: Ottawa Valley realtor says increase in capital gains tax hurts those forced to sell due to financial pressures (Inside Ottawa Valley)

June 19, 2024 – Federation of Ontario Cottagers’ Association lobbies against capital gains tax change (Global News)

June 19, 2024 – The capital gains debate has turned dramatic and mysterious (CBC News)

June 15, 2024 – Capital Gains Tax Changes Threaten Middle Class Families In Ontario’s Rural Communities: FOCA Says (Muskoka 411)

June 12, 2024 – Federal government moves ahead on upping capital gains tax (Cottage Life)

June 11, 2024 – Increase to capital tax gains passes – read coverage from the Toronto Star and the Globe and Mail

June 10, 2024 – Liberals Table Capital Gains Tax Changes: Recreational Property Owners, Take Note (Storeys.com)

May 27, 2024 – Why Freeland’s delay in tabling capital gains tax has Canadians facing costly conundrums (National Post)

May 27, 2024 – Ontario cottage country sees soaring prices amid new capital gains tax increase (Real Estate Magazine)

May 22, 2024 – Editor Michelle Kelly on why the government should reconsider the new capital gains tax rate (Cottage Life)

May 12, 2024 – Planning to sell your cottage before capital gains tax changes kick in? Here’s how you may be able to keep it in the family (Toronto Star)

May 11, 2024 – Capital Gains Tax Hike Spooks Canadian Cottage Owners (ReMax.ca)

May 8, 2024 – Selling a cottage will take more careful planning under new tax rules (Globe & Mail)

May 7, 2024 – There’s room for good financial planning – and for error – before the June 25 capital-gains tax change (Globe & Mail)

April 30, 2024 – Capital Gains Tax Changes Not Included in Feds’ Budget 2024 Motion Bill (Betakit.com)

Apr. 30, 2024 – Freeland moves for separate Commons vote on capital gains tax changes (CBC News) – “Finance Minister Chrystia Freeland intends to ask Parliament to approve proposed changes to capital gains taxation in a stand-alone bill — a move that will force the federal Conservatives to take a specific position on the measure. … The changes are expected to come in a separate piece of legislation. Hiving it off will force opposition parties to take a specific position on capital gains, rather than a laundry list of budget policies that are subject to a single vote.”

April 30, 2024 – Capital Gains Tax Changes Not Included in Feds’ Budget 2024 Motion Bill (Betakit.com)

April 28, 2024 – Time to sell your investment property? Claim your cottage as a principal residence? How to navigate the capital gains tax changes (Toronto Star)

April 28, 2024 – Increase in capital gains tax rate could spawn cottage sales boom (National Post)

April 27, 2024 – Cottage owners race to sell ahead of capital gains tax changes and the Home of the Week: Canadian real estate news for April 27 (Globe & Mail)

April 25, 2024 – New capital gains tax rate will make it harder to keep cottages in the family, FOCA says (MuskokaRegion.com)

April 24, 2024 – Ontario cottage owners are selling out ahead of new capital gains tax (Streets of Toronto)

April 24, 2024 – Cottage country up in arms over capital gains tax (video – CTV News)

April 24, 2024 – ‘It’s chaos’: Cottage owners rush to sell ahead of capital gains tax changes, realtors say (Globe & Mail)

April 24, 2024 – Cottage listings to rise as owners try to sell before capital gains tax changes kick in, realtors say (Toronto Star): Owners face pressure to sell now in tough market conditions — or wait and possibly pay a bigger tax bill.

April 23, 2024 – Federal capital gains tax rate increase will ‘negatively impact’ middle-class cottage owners (Kawartha NOW): Federation of Ontario Cottagers’ Associations warns of ‘devastating effect’ on the family cottage tradition

April 23, 2024 – New Canadian Capital Gains Tax Rate Negatively Impacts Middle Class Families That Own Cottages (Muskoka 411)

April 22, 2024 – Own a cottage or investment property? Here’s how to navigate the new capital gains tax changes (Globe & Mail)

April 17, 2024 – How the federal government’s recent capital gains announcement will impact cottagers (Cottage Life)

April 17, 2024 – Your questions answered about the proposed capital gains tax changes (CBC News).

Other Taxes & Regulations of Note:

Related News: Jan 4, 2023 – Federal and provincial legislation that cottagers should pay attention to (Cottage Life) – an overview about the Non-Resident Speculation Tax; Bill 23; Bill 109; Bill 39; Underused Housing Tax (UHT); and the Prohibition on Purchase of Residential Property by Non-Canadians Act.

About the Foreign Homebuyer Ban (federal) & Tax (provincial):

February 4, 2024 – Federal government extends foreign buyer ban on Canadian homes to 2027 (Canadian Press)

Jan 4, 2023 – Foreign homebuyer ban: What it could mean for markets where the new rules don’t apply (Global News) – “Canada’s two-year ban on non-resident buyers, which came into effect on Jan. 1, doesn’t apply to every buyer, every kind of property or every market in the country. For instance, the federal government confirmed in the legislation introduced late last year that the ban on non-resident buyers doesn’t include recreational properties like cottages…”

March 29, 2022 – Ford government boosts provincial foreign homebuyer tax to 20%, applying it provincewide (CBC News) – where previously it was 15% and only applied to properties in the Greater Golden Horseshoe region.

related: April, 2022 – Ontario expands foreign home buyers tax (KPMG)

About the Underused Housing Tax (UHT):

NOTE: FOCA provides the following update for information purposes only, and not as legal or taxation advice; consult a professional about your own situation.

Get information from the federal government about what the UHT is, who is affected, and who is exempt.

April 30, 2024 – federal Bill C-69 (tabled as the federal budget vote) includes proposed changes to UHT for specified partnerships, trusts, or corporations as “excluded owners” who could be allowed to skip filing UHT returns starting with the 2023 calendar year. Read analysis from Grant Thornton on this issue.

March 13, 2024 – CRA fixes issue with Underused Housing Tax online form that was preventing island cottagers from filing (Cottage Life)

November 23, 2023 – UHT update: as part of the federal government’s Fall Economic Statement (PDF, 141 pages), most Canadian corporations, partnerships, and trusts have become “excluded owners” for UHT purposes and no longer need to file the tax form annually; however, American owners of Canadian seasonal properties are still implicated in the filing requirements. Read related analysis from the Financial Post here, and click here to scroll down on this webpage to FOCA’s additional UHT information, including another announcement about a new extension to the 2022 filling deadline.

Oct. 31/2023 – Underused Housing Tax UPDATE: the Government of Canada has now extended the UHT filing deadline for the 2022 taxation year to April 30, 2024. Get details here and more background below. (Note that filing for the calendar 2023 will also be due on April 30, 2024.)

March 30/2023 – UHT – If you owned some types of residential property in Canada on December 31, 2022 and are neither a Canadian citizen nor a permanent resident: “even if your ownership of the property qualifies for an exemption and you do not owe any tax, you still must file a return” according to the Canadian Revenue Agency (CRA).

Affected property owners should consult the CRA information about their specific situation, but generally:

- This week, FOCA learned that penalties for late filing and interest will be waived in this transitional year, provided the return is filed and any UHT is paid by October 31, 2023 [subsequently updated to April 30, 2024 – see above].

- Non-Canadians who need to file the UHT form should apply to CRA for an Individual Tax Number (ITN) as soon as possible. These requests can take up to eight weeks to process, so the sooner you can start that process the better. This number will be needed for any future dealings with the CRA, such as UHT filings, so please remember to store your ITN safely.

- To get an ITN you need to complete the application form and mail it along with the applicable government ID (certified or notarized copies).

- Complete form T1261 for the Underused Housing Tax.

- Should you object to any late filing or other penalty levied, you can file an objection through taxpayer relief provisions available.

Consult this government UHT webpage outlining who is “excluded” and who is “affected” by this tax, which is assessed annually as 1% of the property value. Note: you won’t be able to use the CRA’s UHT Designation Tool if you are water-access only or your property does not otherwise have a postal code. Below are 2 additional links provided by the Office of the Minister of National Revenue. Also read the earlier news, below, for more background on this subject.

Also, download a 2-page info sheet (PDF) with a great overview of the issues surrounding UHT and who it applies to, from Accounting KW, June 2023.

~

Related & Earlier News about the UHT:

Since May 2023, US Congress members led by Western New York Congressman Brian Higgins have been pressing for exemptions from the UHT for American owners of summer residential property in Canada. To date, over 400 Americans have responded to the Congressman’s survey asking for details on how this tax affects them. Access the survey here. Read Congressman Higgins’ June 2023 brief to the Canadian House of Commons Standing Committee on International Trade (PDF, 10 pages).

January 26, 2023 – Underused Housing Tax (UHT): Last year, FOCA pressed the government for clarity about the new UHT (that was implemented by the federal Department of Finance effective January 1st, 2022 and is payable at tax-time in 2023), asking that seasonal owners be excluded from this tax (1% of the property value, annually), and the government did eventually bring forward an exemption for Canadian owners of vacation or recreational properties, with certain conditions. Nevertheless, cottage owners who are neither Canadian citizens nor permanent residents may still be affected. Amazingly, there is still no posted information about how to file a return, and FOCA’s latest inquiry (January 17) has gone unanswered.

Feb.8, 2023 – The Underused Housing Tax affects more people than expected (Globe & Mail)

July 12, 2022 – As a cottager do I have to pay the Underused Housing Tax? (Cottage Life, quoting FOCA)

July 12, 2022 – US Congressman Higgins requests meeting with Canadian Finance Minister Chrystia Freeland to address Underused Housing Tax (Niagara Frontier Publications; WNYpapers.com)

June 29, 2022 – Canada’s new Underused Housing Tax Act receives Royal Assent (Ernst & Young)

March 2022 – Since mid-last year, FOCA has been expressing concerns about the new Underused Housing Tax (UHT) which was implemented effective January 1, 2022 by the Canadian federal Finance department, and will be assessed/payable in 2023. FOCA’s concern was that secondary property owners (“cottagers”) could be unfortunately and mistakenly penalized by a federal policy that is really designed to free up rental and other accommodations in population centres (mostly urban) that are facing housing shortages. It is now clear that Canadian owners of secondary properties will not be impacted by this tax; however it remains unclear for American and other foreign owners of rural waterfront property in Canada. FOCA remains vigilant on this issue. Read related information here:

- Federal Government Releases Draft “Underused Housing Tax” Legislation (Thorsteinssons LLP; Jan. 2022)

- Underused Housing Tax (UHT): New Proposed Tax for Non-Resident Property Owners (DJB Chartered Accountants; Oct. 2021)

- Government of Canada consultation on the UHT (2021)

Also, here is a March 2023 update about the UHT from our legal colleagues at BLG who supplied the following information to FOCA: The Minister of National Revenue announced the following in the Economic and Fiscal Update 2021 released on December 14, 2021: “Furthermore, the government plans to bring forward an exemption for vacation/recreational properties, which would apply to an owner’s interest in a residential property for a calendar year if the property: (1) is located in an area of Canada that is not an urban area within either a census metropolitan area or a census agglomeration having 30,000 or more residents; and (2) is personally used by the owner (or the owner’s spouse or common-law partner) for at least four weeks in the calendar year.” Currently, the proposed Underused Housing Tax Act (the “Act”) does not explicitly contain this exemption. However, it does give the Ministry of Finance the ability to create “prescribed” classes of property by regulation, and also to create new exemptions that apply if a property “is located in a prescribed area and prescribed conditions” are met. It is possible that the announced exception is therefore intended to be contained in this regulation, but no draft regulations have yet been issued. In other words, this exemption may be addressed by regulation at a later date. We are expecting to see fairly comprehensive regulations issued after the Act is implemented, as many details of the Act are left to be prescribed. Until this exemption is prescribed by regulation, however, it is still possible that cottage owners who are neither Canadian citizens nor permanent residents will be subject to Underused Housing Tax if they do not fall within another exemption under the Act. That said, note that just like the Act itself, which as drafted will be effective retroactively to January 1, 2022, it is possible that the regulation will be retroactive to January 1 as well.

January 2025 – watch this video discussion from The Agenda at TVO, about how Ontario’s property tax dollars are spent (YouTube video posting)

About the Municipal Property Assessment Corporation (MPAC)

July 25, 2024 – MPAC has launched a “Property Pulse Dashboard” tool to empower homeowners to make informed decisions about residential properties, with sales data by municipality and property type, including waterfront properties. To log in or register, you will need your tax roll number and access code from your Property Assessment Notice.

May 2024 – MPAC has also launched an interesting “Housing Inventory” digital tool that allows you to zoom in or out, click to select an area, and explore changes in valuation ranges from 2023, 2018, and 2013. Access it here: https://www.mpac.ca/HousingInventory

April 2024 – MPAC has released new statistics, including a list of the Top 10 northwestern Ontario communities with the highest growth in new assessments last year. Leading the list? Thunder Bay, with Kenora, Shuniah and Sioux Lookout not far behind. Click the image at the side to enlarge the data (copied from a tweet by @MPAC_Ontario on X late last month).

March 2024 – MPAC spoke to FOCA members at the Spring Seminar. Property values have certainly increased since 2016; however, this does not necessarily mean your property taxes will increase this year. It is how your property’s value has changed relative to other properties in your area that affects the distribution of taxation. Watch a video about this, at the side.

You asked, FOCA answers: Property Re-assessment

A member asked FOCA:

We recently did some renovations to the cottage which triggered a reassessment notice from MPAC. I know retail sales prices have gone crazy in this area over the past 18 months. My question: is the new assessed value I received from MPAC based on current (2021) comparables, or 2016 values?

You're missing the answer - it is members-only content!

The following resources are only available to members of our Member Associations & current Friends of FOCA (our annual supporters).

If you are already registered on the FOCA website, please login below with your Username and Password.

Need help with your login? Contact us for assistance during business hours. Not yet a Member Association? Find out why you should be!

November 14, 2023 – the Municipal Property Assessment Corporation (MPAC) has begun mailing more than 713,000 Property Assessment Notices to property owners across Ontario. If you recently moved, changed the school board that your taxes support, or made changes to your property, a notice is on the way. Learn more in this media release from MPAC.

August 16, 2023 – Property Assessment Update: the Ontario government filed a regulation to amend the Assessment Act, extending the postponement of a province-wide reassessment through the end of the 2021-2024 assessment cycle. This means that property assessments for the 2023 and 2024 property tax years will continue to be based on fully phased-in January 1, 2016 current values. The government also announced that it will conduct a review of Ontario’s property assessment and taxation system. For more on the assessment process, members can login below for slides from a 2022 presentation from the Municipal Property Assessment Corporation.

March 2023 – for a longer overview about the role of MPAC and how your property assessment is made, watch this one hour video:

“MPAC 101 – The Role of MPAC in the Property Tax and Assessment System”

2023 Property Tax update from the Municipal Property Assessment Corporation (MPAC):

- due to the COVID-19 pandemic, the Ontario government postponed the 2020 Assessment Update

- property assessments for the 2022 and 2023 property tax years will continue to be based on January 1, 2016 current values

- as soon as an assessment announcement is made, property owners will be made aware.

The ongoing assessment postponement does not change the work underway to maintain the extensive property database and annual assessment rolls. As part of MPAC’s role to assess and classify more than 5.5 million properties across Ontario, they produce an annual report to discuss all their activities that support municipalities to make informed decisions about their community, including the distribution of property taxes. Since MPAC’s last report, Ontario has grown by approximately 100,000 new properties and they have added more than $37 billion in new assessment from new construction and improvements to existing properties. You can read the 2022 report here: https://news.mpac.ca/2022-municipal-partnerships-report.

MPAC also provides many services that help municipalities to maintain accurate records, including updating address, ownership, and school support changes, classification changes (including exemptions), tax applications, as well as severances and consolidations.

More information on property assessment and taxation is available from MPAC here: https://www.mpac.ca/en/UnderstandingYourAssessment/PropertyAssessmentandPropertyTaxes

According to MPAC, the ongoing assessment postponement does not change the work underway to maintain the extensive property database and annual assessment rolls. As part of MPAC’s role to assess and classify more than 5.5 million properties across Ontario, they produce an annual report to discuss all their activities that support municipalities to make informed decisions about their community, including the distribution of property taxes. Since MPAC’s last report, Ontario has grown by approximately 100,000 new properties and they have added more than $37 billion in new assessment from new construction and improvements to existing properties.

Read related MPAC reports: 2022 Annual Report and 2022 Municipal Partnerships Report.

A reminder: as a property owner you have the right to dispute the MPAC valuation of your property every year through the Request for Reconsideration (RfR) process (read more about that process, below). During 2022, MPAC completed a total of 10,069 RfRs and of these, 5,070 led to a change to the current value assessment of the property. Note that MPAC assesses the value of over 5.5 million properties in Ontario each year.

MPAC also provides many services that help municipalities to maintain accurate records, including updating address, ownership, and school support changes, maintaining voter information, classification changes (including exemptions), tax applications, as well as severances and consolidations.

This is members-only content!

- Download the slides (PDF, 16 pages) from a presentation by the Municipal Property Assessment Corporation (MPAC) at the 2022 FOCA Spring Seminar about the current state of property assessments, how assessments are calculated, and recent assessment trends in various cottage country municipalities.

Understanding your Ontario Property Taxes:

Learn more about what affects your property taxes, and what you can do about it.

Property assessment is just one component that affects your property taxes. If you feel the valuation for your property is wrong, consider challenging it, as described below.

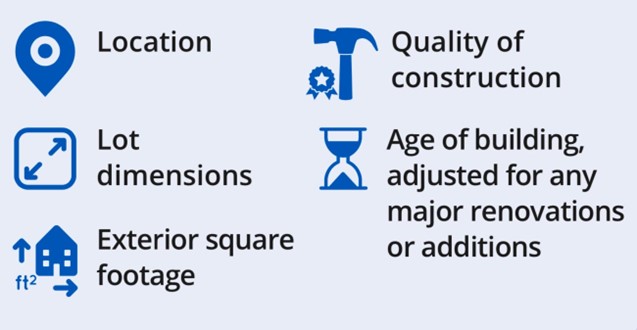

Your property taxes are affected by:

- the education tax rate (set by the Province)

- the municipal budget (established by your Municipality)

- the municipal tax rate (set by your City/Municipality)

- your property’s assessed value (determined by MPAC – see below)

Related News (2014): How Property Taxes Work (Torontoist.com)

~

What can you do about your property taxes?

1) Prevent an increase in your municipal tax rate:

Municipal governments across Ontario are currently formulating and approving their annual budgets. Local spending decisions being made early in the calendar year will directly affect your municipal property tax bill. Every property owner and resident should be paying attention. NOTE: the tax bill you receive early in the calendar year is based on an INTERIM rate, but this will change, pending municipal budget decisions. Learn more about how to get involved in your local municipal budget-setting process on FOCA’s Government Engagement webpage.

2) Challenge your property’s assessed value:

The Municipal Property Assessment Corporation (MPAC) is responsible for assessing and classifying more than five million properties in Ontario. These property assessments are what municipalities use to base the property taxes needed to pay for community services. NOTE: The valuation process is intended to work on a four year cycle; however, due to the global pandemic, the cycle of new valuations that would have been sent out in 2020 were postponed. As a result, your property assessment reflects the assessed value and classification of your property as of January 1, 20216, and this will be used as the basis for calculating your 2023 property taxes. MPAC may still have sent you a revised assessment notice in 2022 if you renovated buildings on your property, if you bought or sold a property (or otherwise changed the property ownership), or if a structure on your property was assessed for the first time.

If you feel MPAC has made an error and assessed your property value too high, you may want to submit a Request for Reconsideration (RfR) to MPAC after the next valuation. There is no charge to do this, but you must submit your RfR within 4 months of the date on your MPAC assessment.

Start by reviewing your property’s details on AboutMyProperty, MPAC’s free online web portal. You will have to register with the Roll Number and new Access Key on your Property Assessment Notice for the 2017 to 2020 property taxation years.

If you can find evidence of comparable properties in your area at lower valuations, it will be in your best interests to proceed with an RfR. You will need the User ID and Password included on your last Assessment Notice, or send a written request to:

MPAC

Attention: GRAD

P.O. Box 9808

Toronto ON M1S 5T9

E-mail: enquiry@mpac.ca / Phone: 1-866-296-6722 / Fax: 1-866-297-6703

* Since 2016: Your deadline to file a RfR will depend on the mailing date on your property assessment notice. The previous deadline (March 31 of each year) NO LONGER APPLIES.

For areas of the province where mapping is not available on MPAC’s site, you can search at the municipal level through an address search. If you want to look up a property that is not in your neighbourhood, but still within your municipality, you can enter the address in the property search window to get a “Property Detail Snapshot”.

Please note: the following is archival material, and some links to third-party resources may no longer be active.

It is FOCA’s view that an updated and strengthened EBR can provide better environmental protection, public participation, and provincial government accountability. The LCO is currently seeking public feedback on this important topic. Learn more, and find out how to submit comment to LCO by November 25, 2022: https://www.lco-cdo.org/en/our-current-projects/environmental-accountability-rights-responsibilities-and-access-to-justice/

November 4, 2021 – In their Fall 2021 economic update, the Province announced that “the priority is maintaining stability for taxpayers and municipalities at this time”, and therefore, the reassessments that were scheduled to be conducted for the 2021 and 2022 tax years were postponed. As such, property assessments for the 2022 and 2023 tax years will continue to be based on the same valuation date that was used for 2021. For more, visit MPAC’s (Municipal Property Assessment Corporation) webpages:

November 20, 2019 – Value of more than 800,000 Ontario properties to be reassessed this year (Durham Radio News)

August 19, 2020 – Top Aggregate Producing Municipalities of Ontario (TAPMO) asks Ontario government to increase property taxes on quarries (Equipment Journal)

July 29, 2020 – Ontario government not considering expanded taxation powers for cities (Ottawa Citizen)

July 27, 2020 – Up to $4 billion to be made available to Ontario municipalities from Canada and Ontario, as part of the Safe Restart Agreement (Ontario)

May 20, 2020 –AMO calls on Canada, Ontario for support for COVID-19 emergency expenses (AMO)

May 19, 2020 – AMO and CUPE call on the province and the federal government to work together on much needed financial assistance to Ontario municipalities (Business Wire)

The 2019 Ontario Budget is proposing changes to the Estate Administration Tax Act. Learn more: https://www.fin.gov.on.ca/en/tax/eat/

August 19, 2019 – Why municipalities are worried about the return of “the D word”: Downloading (TVO)

August 1, 2019 – Ontario Cities with the Highest and Lowest Property Tax Rates (and why do they vary from city to city?) (Zoocasa)

April 26, 2019 – Provincial government moving ahead to reduce the amount of money families pay in estate taxes after the death of a loved one (London Free Press)

June 2, 2018 – NDP propose whopping new housing speculation tax (Toronto Sun): “Ontario NDPers say they would work to ensure their version of the tax does not apply to family cottages”

May 19, 2018 – Property tax was never designed to fund provincial programs

(Toronto Star)

BC Vacation Homes / out of Province owners facing punitive taxation

In the February 20, 2018 Provincial budget, B.C. included what the government is calling a speculation tax. It would apply to owners who do not pay income tax in British Columbia. Principal residences are exempt, as are properties with long-term renters. The tax in 2018 will be 0.5 per cent of a property’s assessed value, a rate that rises to 2 per cent for 2019 and thereafter. (Globe and Mail)

August 28, 2017 – Bracebridge mayor explains benefits of proposed HST hike on property taxes; HST increase proposed to help municipal infrastructure costs (Muskokaregion.com)

August 24, 2017 – Provincial leaders reject HST infrastructure solution (Minden Times)

August 2017 – Municipal governments collect only 9% of all taxes. Property taxes can’t keep up with growing local needs, and the Association of Municipalities Ontario (AMO) have identified an almost $5 billion funding gap for the next 10 years to maintain current services and address the infrastructure gap. See the full perspective from AMO http://thelocalshare.ca/

July 5, 2017 – Lower property tax rate based on services received? According to this former appraiser, “Property tax, assessment not easy, but fair: Gravenhurst resident”

(Letter to the Editor, Gravenhurst Banner)

June 2, 2017 – HST hike suggested by AMO as a way to close the $4.9 billion infrastructure gap for municipalities (Postmedia)

April 20, 2017 –Wynne to slap 15 per cent tax on foreign real estate speculators; will roll out a 15 per cent “non-resident speculation” tax to help cool down southern Ontario’s real estate market. (Toronto Star)

April 18, 2017 – Ontario promises curbs on hot housing market within a week (CBC News)

Sousa had asked Morneau last month to boost the capital gains tax rate, but the federal minister made no change in the 2017 Federal budget. On Tuesday (April 18), Morneau shot it down definitively. “Everything we wanted to say about capital gains taxes was in our last budget,” he said.

April 18, 2017 – What governments could do to cool GTA real estate market; Federal finance minister holds urgent meeting with provincial, city officials on reining in house prices (CBC News)

April 12, 2017 – Real estate speculators driving up prices to be target of reforms, Sousa says

(Toronto Star)

April 12, 2017 – Liberals try to fix Toronto’s housing market without sinking it (Ottawa Citizen)

“Engineering a result so precise with something as big and plainly irrational as the housing market is not easy. All the worse if the things you do affect millions of other Ontarians who haven’t lost their minds.”

April 6, 2017 – Ontario Finance Minister wants meeting on house prices with federal counterpart soon (Toronto Star)

March 31, 2017 – In light of the troubling proposals by Ontario’s Finance Minister, FOCA issued this letter to the Provincial and Federal Ministers of Finance, and a media release in early April. With over $750 billion (CIBC, 2016) in inter-generational asset transfer set to occur over the next 10 years (including a significant amount of waterfront property staying within the family), FOCA will strongly oppose any further capital tax burden.

March 20, 2017 – Ontario wants Ottawa to boost tax on real estate speculators – Federal Finance Minister Bill Morneau urged to cool housing market by increasing capital gains tax (CBC News)

March 8, 2017 – Municipalities are responsible to set property tax policy (Elliot Lake Standard)

February 17, 2017 – Expect to pay more tolls, higher property taxes to fund infrastructure (CBC News)

March 2016 – MPAC presented a 2016 Property Tax update to the FOCA Spring Seminar. A copy of this presentation can be made available to FOCA Members. * Note: starting with the 2016 tax year, your deadline to file a RfR will depend on the date you receive your property assessment notice. The previous deadline (March 31 of each year) NO LONGER APPLIES.

February 2016 – See FOCA’s 2016 Pre Budget letter to the Ontario Minister of Finance

August 15, 2016 – Wynne advises Ontario municipalities to consult constituents on new local taxes

December 1, 2015 – Cities outside Toronto cannot charge land-transfer tax, Ted McMeekin says (Toronto Star)

July 24, 2015 – Municipal officials in Fort Frances, Dryden, Espanola and other small rural Ontario towns have dealt with decreased industrial assessments by raising residential taxes, cutting jobs and slashing infrastructure spending. Tax shift: Companies dump burden of taxes on squeezed municipalities (Globe and Mail)